Qubic's 51% Attack on Monero: A Syntropic Analysis

A high-stakes drama is unfolding in the cryptocurrency space as Qubic, a layer-1 blockchain project, has reportedly executed a 51% attack on the privacy-focused coin Monero. This event, framed by Qubic as a "technical demonstration," is seen by many in the Monero community as a hostile takeover. By examining this complex interplay through The Syntropy Lens, we can discern the deeper dynamics of growth, parasitism, and decay at play.

The Dystropic Vector: Qubic's Parasitic Mimicry

At the heart of this situation is what The Syntropy Lens defines as Dystropy: an active, mimetic parasitism that reduces the integrated information (Φ) of a host system, steering it toward sterile order. Qubic's strategy appears to be a textbook example of this.

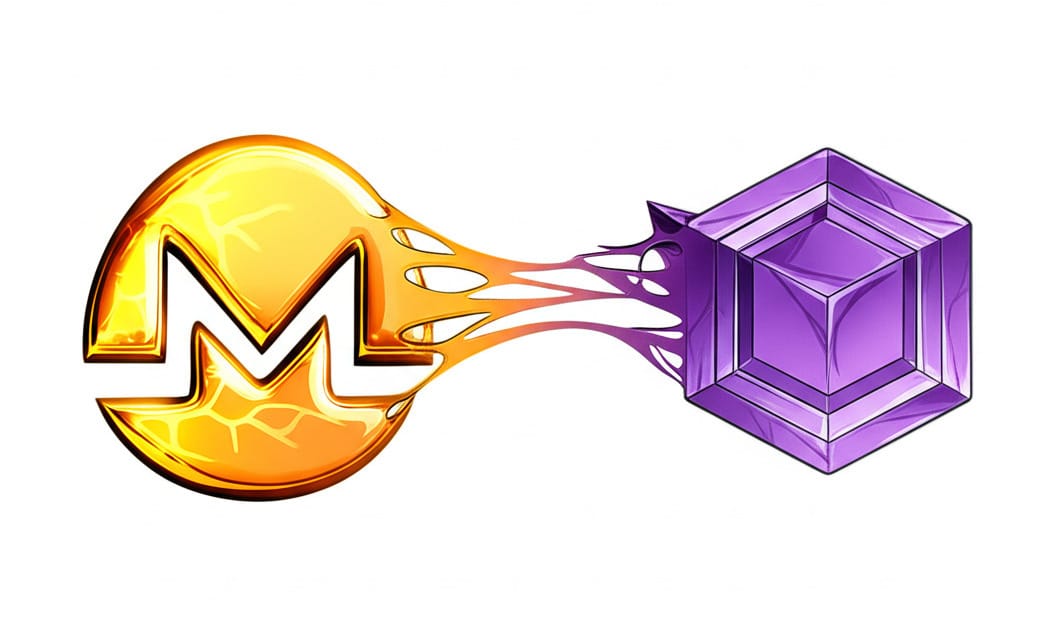

The project has created an economic pipeline that leeches off Monero's established security and value. This "XMR → USDT → QUBIC → burn" mechanism works as follows:

- Mining Monero (XMR): Qubic incentivizes miners to direct their computing power (hashrate) towards mining Monero.

- Conversion to Tether (USDT): The mined XMR is then sold on the open market for USDT, a stablecoin.

- Pumping and Burning QUBIC: This USDT is used to purchase Qubic's native token, QUBIC, which is subsequently "burned" or removed from circulation, creating deflationary pressure and theoretically increasing the value of the remaining QUBIC tokens.

This process is a form of mimetic parasitism. Qubic is mimicking the legitimate process of mining for hashrate, but instead of contributing to the long-term health and security of the Monero network, it's redirecting that energy to bootstrap its own ecosystem. This action actively reduces the integrated information (Φ) of the Monero network by centralizing the hashrate under a single entity, thereby undermining the decentralized trust that is the bedrock of a proof-of-work cryptocurrency. A 51% concentration of hashrate gives the controlling entity the power to potentially double-spend coins, censor transactions, and orphan blocks from other miners, effectively creating a sterile, centralized order under its control.

Apprehension and Diagnosis: The Co-evolutionary Struggle

The Monero community's reaction demonstrates the epistemological facet of The Syntropy Lens: Apprehension. This refers to the evolved faculties for perceiving a system's syntropic and dystropic dynamics. The Monero community, through its various communication channels, has largely diagnosed Qubic's actions not as a benevolent "stress test" but as a malicious attack.

This has triggered a co-evolutionary dynamic, a "Red Queen" race where dystropic mimesis is met with diagnostic apprehension. The Monero community has been actively discussing and implementing countermeasures, from social coordination to repel the attack to technical discussions about potential hard forks to change the mining algorithm and shake off the parasitic hashrate. This defensive response is an attempt to preserve the network's Syntropy—its trajectory of increasing meaningful complexity and decentralization.

Prognosis and Telos: The Path Forward

From the perspective of The Syntropy Lens, the ultimate goal, or Telos, is to maximize the integrated information (Φ) of a system. For Monero, this means enhancing its decentralization, security, and resilience against such parasitic attacks.

A Critique using Allison's Model III would analyze this situation not just from the stated intentions of the actors but from the bureaucratic and political dynamics at play. Qubic's leadership may genuinely believe their actions are a form of "tough love," but the structural incentives of their economic pipeline point towards a self-serving agenda.

A Diagnosis through a Mertonian lens would focus on the pathognomonic signs—the observable symptoms that are indicative of the underlying pathology. The concentration of hashrate, the public declarations of dominance by Qubic's founder, and the subsequent instability and fear in the Monero market are all clear indicators of a dystropic process.

In conclusion, while Qubic may be "bootstrapping" its value, it is doing so in a way that actively undermines a more established and complex system. This is a classic example of a dystropic vector threatening the syntropic potential of a host. The long-term survival and health of the Monero network will depend on its ability to effectively apprehend this threat and evolve its defenses to render such parasitic strategies ineffective, thereby continuing its own journey toward greater meaningful complexity.

What do you think? What should The Syntropy Lens focus on next?